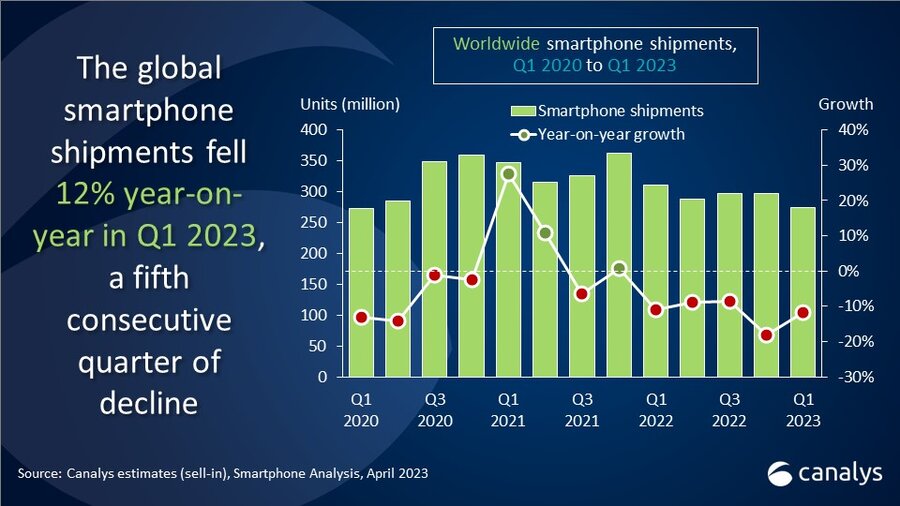

According to various reports from research firms such as IDC and Canalys, the global smartphone market declined by around 12% year-on-year in the first quarter of 2023, marking the fifth consecutive quarter of decline. The total shipments of smartphones were estimated at around 270 million units, down from 307 million units in Q1 2022. The main reasons for the decline were weak consumer demand, high inflation, and macroeconomic uncertainties in several markets.

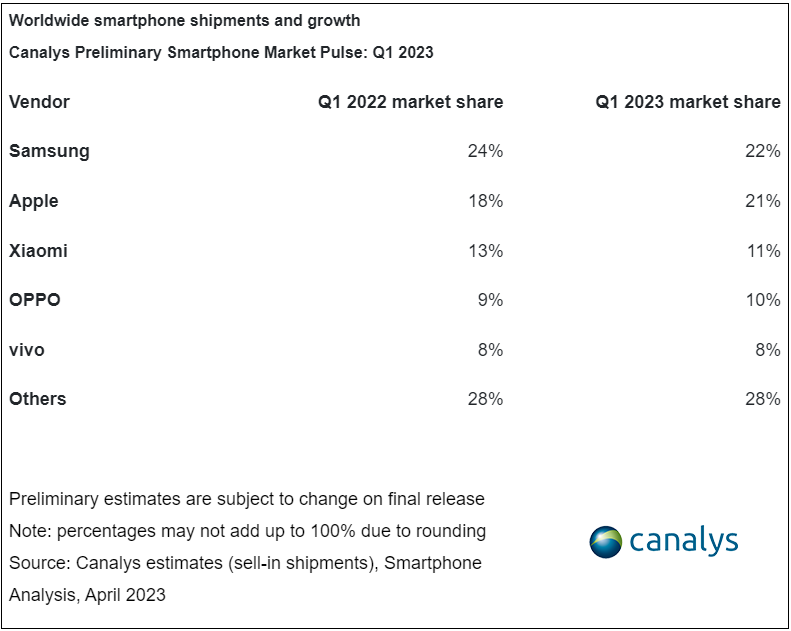

However, not all smartphone vendors were affected equally by the market downturn. Samsung regained its top spot as the largest smartphone vendor by shipments, with a 22% market share and a 4% year-on-year growth. Samsung benefited from its strong portfolio of devices across different price segments, especially its flagship Galaxy S23 series, which featured a 200MP camera sensor and a built-in S Pen. Samsung also launched its mid-range Galaxy A54, which competed well with other devices in the same category.

Apple was the second-largest smartphone vendor by shipments, with a 21% market share and a 2% year-on-year growth. Apple’s iPhone 14 series continued to perform well, especially in developed markets such as the US and Europe. Apple also launched its iPhone SE (2022), which offered a more affordable option for consumers who wanted to experience iOS. Apple’s iPhone sales were also boosted by its loyal customer base and its ecosystem of services and accessories.

Xiaomi was the third-largest smartphone vendor by shipments, with an 11% market share and a 10% year-on-year growth. Xiaomi was the only vendor among the top five that achieved double-digit growth in Q1 2023. Xiaomi’s success was driven by its aggressive expansion in overseas markets such as India, Southeast Asia, Latin America, and Africa. Xiaomi also offered a wide range of devices with attractive features and prices, such as its flagship OnePlus 11 series and its budget-friendly Redmi Note 11 series.

The other two vendors in the top five were Vivo and Oppo, both with a 9% market share and a slight year-on-year decline. Vivo and Oppo faced some challenges in their home market of China, where they faced competition from Huawei, which was recovering from US sanctions. Vivo and Oppo also faced some difficulties in expanding their presence in other regions due to regulatory hurdles and brand awareness issues.

Looking ahead, the smartphone market is expected to recover gradually in the second half of 2023, as consumer confidence improves and supply chain issues are resolved. According to IDC’s forecast, smartphone shipments will decline by only 1.1% in 2023 to 1.19 billion units, compared to the previous forecast of a 2.8% decline. Some of the factors that will drive the market recovery include:

– The launch of new flagship devices from major vendors such as Samsung’s Galaxy S23 Ultra Plus and Galaxy Z Fold 4, Apple’s iPhone 15 series, Google’s Pixel 7 series, and Huawei’s Mate 50 series.

– The adoption of new technologies such as foldable displays, under-display cameras, periscope zoom lenses, fast charging solutions, and advanced biometric authentication methods.

– The growth of 5G networks and devices, especially in emerging markets where 5G penetration is still low. According to Canalys’ estimate, 5G smartphones will account for more than half of global smartphone shipments by Q4 2023.

– The emergence of new segments and niches such as gaming smartphones, rugged smartphones, blockchain smartphones, and modular smartphones.

– The development of new business models and strategies such as subscription services, trade-in programs, leasing options, and direct-to-consumer channels.

In conclusion, the smartphone market during 2023 was challenging but also resilient. Despite facing some headwinds from external factors, smartphone vendors managed to innovate and adapt to changing consumer needs and preferences. The smartphone market is expected to bounce back in the near future, as new opportunities arise from technological advancements and market diversification.

Share to your social below!