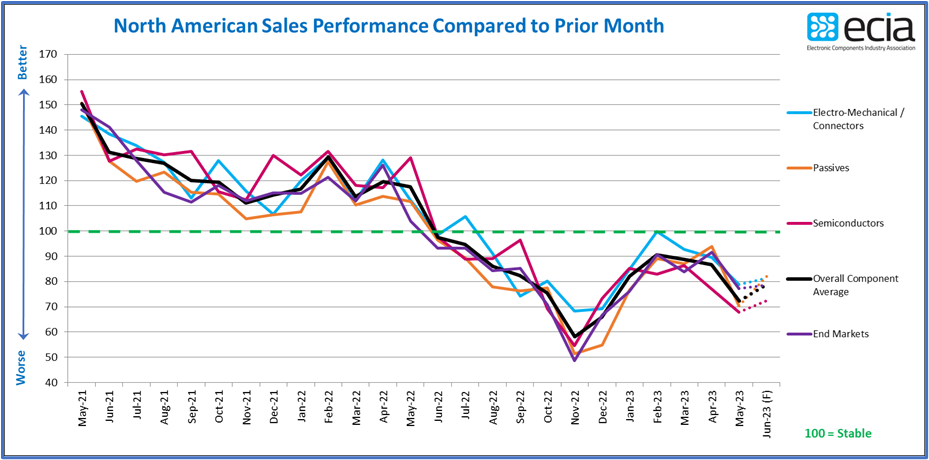

The Electronic Components Industry Association (ECIA) conducts monthly and quarterly surveys to measure the sales sentiment and trends of electronic components in North America. The latest survey results for May 2023 show a sharp decline in sales sentiment compared to April expectations, indicating a prolonged market recovery period.

Overall Sales Sentiment Index

The overall sales sentiment index is a weighted average of the responses from manufacturers, distributors and manufacturer representatives for different product categories and end markets. The index ranges from 0 to 200, with 100 being the neutral point. A higher index indicates a more positive sales outlook, while a lower index indicates a more negative outlook.

According to ECIA’s chief analyst Dale Ford, the overall sales sentiment index for May 2023 collapsed to 72.2 points, compared to 99.1 points expected in April. This is the third consecutive month of declining results, and a dramatic reversal from the previous expectation of achieving a positive outlook over 100 in May. The June outlook only improves slightly to 78.6 points.

The table below shows the overall sales sentiment index for different product categories and end markets for May 2023 and June 2023 outlook:

| Product Category | May 2023 | June 2023 |

| Semiconductors | 67.7 | 75.8 |

| Passive Components | 69.4 | 77.9 |

| Electro-Mechanical / Connectors | 79.5 | 82.2 |

| End Market | May 2023 | June 2023 |

| Avionics/Military/Space | 113.6 | 114.5 |

| Automotive | 100.4 | 101.2 |

| Automotive Electronics | 76.8 | 80.6 |

| Industrial | 72.9 | 77.7 |

| Medical | 71.9 | 77 |

| Consumer | 70 | 76 |

| Communications | 69 | 75 |

Sales Sentiment by Channel

The sales sentiment of manufacturers compared to distributors and manufacturer representatives reveals very different views of the market. Distributors and manufacturer representatives reported extremely bearish inputs with overall index scores of 71 and 60 respectively. At the same time, the overall manufacturer average registered at 91 with three component categories scoring at or above 100.

One possible explanation for these divergent views could be that manufacturers are seeing stronger performance in their direct business while inventory balancing in the distribution channel is still in process.

Quarterly Sales Trends

The quarterly sales trends reflect the expectations for quarter-to-quarter growth in electronic component sales. The results reported in the quarterly survey indicate that a return to meaningful quarter-to-quarter growth will have to wait until Q4 at the earliest.

The table below shows the percentage of respondents expecting better, worse or flat sales for Q2 and Q3 of 2023:

| Quarter | Better (%) | Worse (%) | Flat (%) |

| Q2 | 29 | 32 | 39 |

| Q3 | 32 | 28 | 40 |

Conclusion

The May ECST survey results reported by ECIA show a significant drop in sales sentiment for electronic components in North America, indicating an extended market recovery period with a turnaround in year-over-year growth coming at the end of 2023 at the earliest. The results also reveal a discrepancy between manufacturers and distributors/manufacturer representatives in their views of the market, possibly due to inventory issues. The quarterly survey results suggest that quarter-to-quarter growth will remain flat or slightly negative until Q4.

Share to your social below!

п»їbest mexican online pharmacies: cmqpharma.com – mexico drug stores pharmacies

buying prescription drugs in mexico

https://cmqpharma.com/# mexican pharmaceuticals online

pharmacies in mexico that ship to usa

Very interesting details you have remarked, thank you for

putting up.Blog monetyze

buy canadian drugs escrow pharmacy canada canadian pharmacy ratings

https://indiapharmast.com/# india pharmacy

canada drugs online review: canadian pharmacy 1 internet online drugstore – pharmacy rx world canada

best india pharmacy: mail order pharmacy india – india online pharmacy

canadian pharmacy 24 com adderall canadian pharmacy pharmacies in canada that ship to the us

canadian pharmacy ltd: canada drug pharmacy – canadian online drugstore

online canadian pharmacy: online canadian pharmacy – canadian pharmacy ltd

https://canadapharmast.online/# canadian pharmacies online

pharmacies in mexico that ship to usa: mexican drugstore online – mexican rx online

mexico drug stores pharmacies buying prescription drugs in mexico buying prescription drugs in mexico

purple pharmacy mexico price list: п»їbest mexican online pharmacies – mexico drug stores pharmacies

https://canadapharmast.online/# my canadian pharmacy

online pharmacy india: buy medicines online in india – indianpharmacy com

canadapharmacyonline legit: canadian pharmacy 24 com – canada drugs online

mexican rx online: mexico drug stores pharmacies – mexican mail order pharmacies

https://paxloviddelivery.pro/# paxlovid pharmacy

ciprofloxacin mail online: buy cipro cheap – cipro 500mg best prices

https://clomiddelivery.pro/# can you buy cheap clomid without rx

http://doxycyclinedelivery.pro/# doxycycline 100mg tablet price in india

https://amoxildelivery.pro/# amoxicillin 875 mg tablet

http://doxycyclinedelivery.pro/# doxycyline

http://clomiddelivery.pro/# buying clomid prices

http://paxloviddelivery.pro/# paxlovid for sale

http://clomiddelivery.pro/# cheap clomid without prescription

http://ciprodelivery.pro/# purchase cipro

cost of generic clomid: how to get clomid pills – can i buy cheap clomid no prescription

mexican mail order pharmacies pharmacies in mexico that ship to usa mexico drug stores pharmacies

https://mexicandeliverypharma.com/# buying prescription drugs in mexico

mexico drug stores pharmacies: buying prescription drugs in mexico – reputable mexican pharmacies online

purple pharmacy mexico price list: best online pharmacies in mexico – purple pharmacy mexico price list

best online pharmacies in mexico buying from online mexican pharmacy medication from mexico pharmacy

mexican rx online: mexican drugstore online – mexican mail order pharmacies

mexican online pharmacies prescription drugs: pharmacies in mexico that ship to usa – mexican border pharmacies shipping to usa

https://mexicandeliverypharma.online/# mexico pharmacies prescription drugs

medication from mexico pharmacy buying prescription drugs in mexico mexican online pharmacies prescription drugs

medication from mexico pharmacy: mexican online pharmacies prescription drugs – buying prescription drugs in mexico online

http://mexicandeliverypharma.com/# medicine in mexico pharmacies

buying prescription drugs in mexico: mexican mail order pharmacies – buying from online mexican pharmacy

mexican mail order pharmacies mexican online pharmacies prescription drugs п»їbest mexican online pharmacies

mexico drug stores pharmacies: reputable mexican pharmacies online – buying prescription drugs in mexico

mexican mail order pharmacies: medication from mexico pharmacy – mexico pharmacies prescription drugs

buying prescription drugs in mexico online: mexican border pharmacies shipping to usa – mexican drugstore online

purple pharmacy mexico price list: medication from mexico pharmacy – best online pharmacies in mexico

pharmacies in mexico that ship to usa: medication from mexico pharmacy – medication from mexico pharmacy

mexican online pharmacies prescription drugs: purple pharmacy mexico price list – mexico pharmacies prescription drugs

buying prescription drugs in mexico buying prescription drugs in mexico mexican online pharmacies prescription drugs

buying prescription drugs in mexico: medicine in mexico pharmacies – mexican border pharmacies shipping to usa

mexican pharmaceuticals online: mexican mail order pharmacies – mexico pharmacies prescription drugs

mexican rx online reputable mexican pharmacies online mexico pharmacy

mexican drugstore online: medicine in mexico pharmacies – medication from mexico pharmacy

mexican pharmaceuticals online: medicine in mexico pharmacies – mexico pharmacies prescription drugs

mexico drug stores pharmacies: mexican rx online – mexican online pharmacies prescription drugs

mexico drug stores pharmacies: medication from mexico pharmacy – п»їbest mexican online pharmacies

medication from mexico pharmacy mexico drug stores pharmacies purple pharmacy mexico price list

reputable mexican pharmacies online: buying prescription drugs in mexico online – pharmacies in mexico that ship to usa

purple pharmacy mexico price list: buying prescription drugs in mexico – buying prescription drugs in mexico